· Kenny Nguyen · Business Resource · 4 min read

New Business Acquisition? Here's How Digital Strategy Drives Your Success

When acquiring an established business, the digital assets you inherit can be either valuable springboards or outdated liabilities. The right digital foundation doesn't just complement your business—it accelerates your growth trajectory and enhances your competitive advantage.

Digital Strategy as a Business Asset

For service-based business acquirers, your online presence is far more than a website—it’s a critical business asset that should:

- Convert prospects into clients – Not just attract traffic, but qualify leads and nurture them through your sales process

- Strengthen market positioning – Differentiate your services and communicate your unique value proposition

- Scale operations efficiently – Reduce administrative burden through strategic automation

- Protect and grow existing client relationships – Maintain continuity while expanding service opportunities

Strategic Digital Solutions for Business Acquirers

Business Transition & Digital Continuity

Acquisitions create natural disruption. We ensure your digital transition enhances rather than undermines business continuity:

- Seamless ownership transfer of all digital assets (domains, hosting, accounts)

- Preservation of valuable SEO equity and existing customer pathways

- Strategic communication planning to maintain client confidence during transition

- Analytics implementation to establish performance baselines for measuring your improvements

Strategic Redesign & Optimization

We approach redesigns as strategic business initiatives, not cosmetic updates:

- Conversion-focused design that moves visitors through your specific service model

- Strategic content hierarchy emphasizing your most profitable services

- Technical performance enhancements that improve both user experience and search visibility

- Data-informed improvements based on existing customer behavior patterns

Business Systems Integration

Efficiency drives profitability in service businesses. Our integrations focus on operational excellence:

- Service delivery automation that reduces administrative overhead

- Client communication systems that maintain relationships without constant manual attention

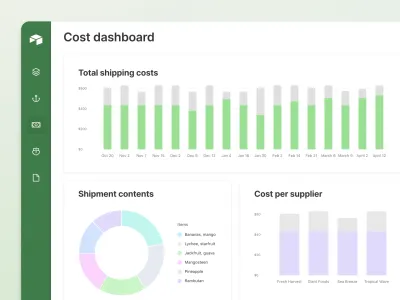

- Business intelligence dashboards providing visibility into key performance metrics

- Process optimization through targeted workflow automation

Alignment with Your Business Acquisition Goals

For Growth-Focused Acquirers

If you’ve acquired a business with expansion potential, we focus on scalable systems that can handle increased volume without proportional increases in overhead.

For Turnaround Specialists

When acquiring an underperforming business, we identify digital inefficiencies and implement targeted solutions that quickly impact bottom-line performance.

For Portfolio Builders

If this acquisition is part of a larger business portfolio, we design consistent digital frameworks that facilitate cross-business efficiencies.

For Industry Consolidators

When consolidating multiple businesses in the same sector, we develop digital strategies that preserve individual brand equity while creating operational synergies.

Our Approach: Strategic Partnership

We work exclusively with business acquirers who value strategic partnership over transactional services. Our process includes:

- Acquisition Assessment – Evaluating inherited digital assets and identifying opportunities

- Strategic Roadmap Development – Creating a prioritized implementation plan aligned with business objectives

- Milestone-Based Implementation – Delivering improvements in priority order to generate early returns

- Performance Measurement – Tracking meaningful metrics that demonstrate business impact

- Ongoing Optimization – Continuously refining digital assets based on performance data

Investment Options Structured for Acquirers

We understand the financial dynamics of business acquisition and structure our services accordingly:

Strategic Implementation Package

- Complete strategic implementation with clearly defined scope and timeline

- Fixed investment with milestone-based payments aligned with your cash flow

- Perfect for acquirers who prefer predictable costs and clear project boundaries

Performance Partnership

- Lower initial investment with ongoing optimization and support

- Performance-based fee structure tied to agreed-upon business outcomes

- Ideal for growth-focused acquirers who value shared risk and reward

Is This Right for Your Business Acquisition?

Our approach delivers exceptional value when:

- Digital presence significantly impacts your customer acquisition and retention

- Your service model benefits from streamlined operations and automation

- You value strategic thinking over tactical execution

- You’re focused on sustainable growth rather than quick cosmetic fixes

However, we may not be the right fit if:

- Digital strategy is peripheral to your business model

- You’re looking for the lowest possible cost rather than strategic value

- You need immediate implementation without strategic planning

Next Steps for Serious Acquirers

If you’ve recently acquired a business or are in the due diligence phase, schedule a Business Acquisition Digital Strategy Session. This focused consultation will:

- Evaluate your acquisition’s digital assets

- Identify immediate opportunities and potential challenges

- Outline a strategic roadmap aligned with your acquisition goals

Schedule Your Strategy Session

“The digital strategy work completed after our acquisition increased our client retention by 92% during the ownership transition and generated a 43% increase in high-value service bookings within the first quarter.” – Sarah Reynolds, Service Business Acquirer